Recession-proof

by Kevin Zhang

Doomsayers are coming out of the woodwork en masse as 2008 ended during a dismal economic downturn. With consumer confidence at an all-time low, the financial industry shell-shocked as grand, monolithic companies crumbled all around, and nearly 2 million jobs lost in the past year, the end looks nigh indeed.

But before you don your sandwich boards and raise high your signs, things may not be as bad everywhere as they seem.

The economy rises and falls in what's called a business cycle. Some years are relatively prosperous with rapid economic growth and expansion while other years see the economy contract or stagnate. These fluctuations last over periods of years and their timing is largely unpredictable.

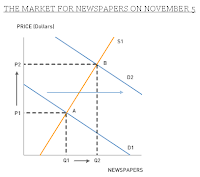

Some firms stick with the general trend of the market, their business conditions weakening when the market weakens, strengthening when the market recovers. These are procyclical firms. Others, countercyclical firms, do the reverse; their business conditions weaken when the times are good, and strengthen when times are bad. There are still other industries that don't depend on how the economy is doing at all.

So, while the bankruptcies and bailouts get the boldest headlines these days, here's a brief list of industries that are doing just fine.

The funeral services industry depends more on long-term trends such as aging populations and baby booms rather than on the twitching of the stock ticker. And of course, it also helps that their services are always in demand.

The entertainment industry is another good example. Revenue from concerts and movies have stayed strong during this economic downturn. Faced with gloom and doom, many find the few hours of escapism well worth the price of admission.

Discount stores, most notably Wal-Mart, are attracting cash-strapped customers looking to get the most out of their money.

As jobs get scarcer, going back to school makes a lot of sense for those looking to weather the fierce competition in the job market and to improve their skills and credentials. According to the Labor Department, the education industry has added 9,800 jobs in November.

Can you think of any other industries that are counter-cyclical? Has the recent recession caused you to rethink your career plans?