Check out this game created by the Federal Reserve. It deals with exactly what we are studying right now, monetary policy. The game puts you in the position of the Fed Chairman, and you must manipulate interest rates in order to balance unemployment and inflation. Click on the learn more button before playing. Investigate the Fed Toolkit and the other items in the help section. After this play the game. Give me a short summary of your strategy and how it went.

62 comments:

Overall, the game was pretty easy. My strategy was based on countering either the unemployment or inflation rates whenever they became too high. For most of the quarters, it wasn't too difficult to stay near the desired numbers.

Well the main strategy is to keep the inflation from following too low due to the various obstacles popping up as it is less volatile than the unemployment rate. The unemployment rate is more prone to change, and so it is much easier to manipulate as compared to inflation, but this also means it's harder to keep in check as it rapidly goes up or down dependent on actions. For lowering or increasing unemployment it is best to make minimal changes, while when inflation needs to be changed higher changes need to be made. So all in all it is best to find a middle ground between the two.

A major point in this Fed Chairman Game is to remember that changes in the federal funds rate takes maybe two or three quarters before really affecting unemploment and inflation rates. So to get the desired levels, you have to pay attention to how greatly the rates are dropping or raising. As for the unexpected events, you have to be ready to drastically change the federal funds rate in response to prevent extreme drops or raises.

I did not do so well as the Fed Chairman. To be honest, i was a little confused as to what exactly i had to do. For example, at one point, the game suggested that to low the inflation rate, you need to increase the federal interest rate. However, when doing so, the inflation rate actually increased. Therefore, i was a bit confused.

One thing that seemed to work is just whenever i managed to level everything out, I didn't vary the rate very much and kept things pretty steady.

Cortney Corley

Period 4

I think that i was a decent federal chairman, but not the best. The unemployment rate, like the other categories, continud to fluctuate over time, but not dramatically. I managed to keep it relatively stable because i paid attention to the news headlines and the graphs. I wanted to keep inflation low, like the game suggested, becasue it would be difficult to recover after inflaton or even hyperinflation. Also, like many other students have pointed out, there may not be immediate effects, things take time to implement.

When I played this game, my main strategy was keeping the unemployment rate low. However, the economy is unpredictable, and random events may occur that can cause a severe increase to the inflation level. AS a result, I did not adjust my interest levels sufficiently to account for these changes, thus causing a case of hyperinflation to occur in my game.

sam kadakia

1st

The game seems to be pretty good with it's impression of how the economy works. Such as capturing its unpredictability, or it's reactions to government policy. For example, when I played it I thought I did well enough since i got my inflation under control and unemp. was at 6.03%. However the game had a delayed reaction to my changes, I'm not sure if it's part of the economy or not.

Kaylah Moore - 1

I played the game three times. The first time I played I watched interest rates closely, and it seemed to pay off, because I was in he game for a while. The second time I played I wathed unemployment closely; I did not last long. Watching the unemployment rate was way too unpredictable, while watching only watching the interest rate did not last me long. My last time playing was much more successful; Although I made sure to keep a close eye on the interest rate, I mae sure to pay attencion to the unemployment rate. I don't know how anyone could run the economy without a crystal ball, because it is way too unpredictable.

Jennifer Shen-1st period

I lost this game several times, and then I found that it may be impossible for anyone to win this game. One time I got 5.06% of unemployment rate and 1.97% of inflation rate, I still lost though. So I'm just gonna assume that I won that time. I think the strategy is to observe the trends of the graphs carefully. For example, if the inflation rate seems like it will go up, I need to increase the interest rate before inflation gets worse because there are some time lags. My adjustment will not work so soon as I make it.

Tyler Morris

1st Period

My strategy was to keep the Feds funds just above the inflation rate, this worked for 9 of the 16 quarters. However, as soon as an oil crisis hit, I had to jack up the prices (only after letting them sit for a quarter) in order to deal with the inflation rate and rising unemployment. I was able to get the funds back down with only three quarters to go. But then the unemployment rate rose again, and I was unable to get the economy back on the stable path. I believe this is because of the one time it was necessary to push the Feds fund up so high, this knocked the fake economy off-track, and it was not easy to recover from.

The strategy is simple. Particularly in this game its trial and error. However, in the real word trial and error could result in a roller coaster like economy which is not good at all. You have to put a lot of attention on the rates per each quarter. Changing the federal funds is the only way to balance and stabilize the economy. This game showed me the true value of monetary policy and how it takes very little to either get the economy into a recession or to inflation all in the hands of the federal government.

Alexander Pappan

4th Period

Well i would always lose because my inflation rates were too high. When the game told me to raise the fed rate to lower interest rates, it took a few quarters for it to actually take effect. But i did find that keeping the rate the same does not help all too much

So this game was very hard. I tried to use strategies of balancing the inflation and unemployment rates, but I am pretty sure that I over complicated everything. All the changes that happened were very dramatic and I overall did not enjoy my experience as the Fed Chairman.

period 3

Period 4

The first time I played the game, I had no idea what I was doing, but the second time, I did really well. My strategy was to keep the federal rates really close to the inflation rate. Then, I raised or lowered it depending on whether inflation or unemployment was the problem. Overall, the game was pretty simple.

Matthew Francis Period 3

I completely messed up and I played the game twice to see whether or not it was a fluke. In hindsight, I feel like I could be a better chairman, but, in reality, I know the job is not for me. I reached 4.18% unemployment and -.05% inflation the second time I played the game. My strategy was predict the unpredictable by maintaining levels until the sudden event occurred and drastically change my strategy.

I think i did pretty well playing this game. I tried to anticipate the events with great success. I ended with a Unemployment rate of 4.92% and a Inflation rate of 3.53%. The game may have wanted a little lower but I think I did pretty well for the 4 quarters I had.

Kristal Pinto

Period 4

On my first try I did not do so well as the Fed Chairman because I didn't have a hang of the methods used. Although my second try turned out to be a little more successful because I started seeing a pattern, so I had to keep increasing and decreasing the inflation rate. I noticed as the inflation rates were high, the unemployment rate was high but the inflation was low and vice versa.

The Fed Chairman game was quite simple but hard to understand at first. Due to lags, the economy wouldn't experience much change until after a few quarters. So raising or lowering the interest rate ahead of time was essential to keeping the employment rate and inflation rate relatively stable. Major adjustments to the interest rates were needed during recessions, oil shortages events, etc.

I let inflation drop until it began to deflate the dollar. Once the dollar was deflating at about 1%, unemployment was under 5% and I gradually allowed the inflation rate to rise to a normal standard. I teared up when the newspaper at the end called me a "Fed guru." I've never worked harder for something in my life.

The game wasn't to difficult, I did poorly in the game, and I think this was because I too radically changed the numbers, instead I think in order to keep the rates pretty steady one must keep the money input pretty steady.

The game wasn't to difficult, I did poorly in the game, and I think this was because I too radically changed the numbers, instead I think in order to keep the rates pretty steady one must keep the money input pretty steady.

I visualized lowering the federal funds rate as squeezing the graphs of inflation and unemployment closer together and raising the federal funds rate as pushing them apart. A few times, I literally had to put my fingers against my computer screen and make squeezing motions with my thumb and index finger to make sure I was seeing things correctly. I thought I did a pretty decent job as Fed Chairman, although the game disagreed.

The game is very simple. I changed the federal funds rate and tried to get a desired unemployment and inflation rate. I tried to keep inflation and unemployment low and played around with the federal funds rate to do so.

The game isn't difficult, if you don't try to help out too much and if you stop a problem before it gets too bad. It's a lot easier to have small changes and is a lot less devastating to the economy than a lot of big changes. If the headlines predict inflation, people then believe it will occur so adjusting the FED rates before the problem begins keeps the problem smaller, and the same for unemployment.

The game was all to simple. I had a careful eye on inflation rates and unemployment. Whenever the inflation rate began to increase I simply raised the federal funds. And when the unemployment rate shot up I lowered the federal funds. The only problem I had was when I decided it would be interesting to see if increased the federal funds by 10 and I immediately was kicked out.

Amita Batra

4th Period

The game requires to have an extremely monetarists point of view. Monetarists believe that the Fed should sit and do nothing rather than try to help out because of the time lag. If the Fed simply does not adjust the rate with great extremities, it is possible to keep the economy stable. Thus, with a good understanding of the monetarist policy, it is possible to attain a leveled economy.

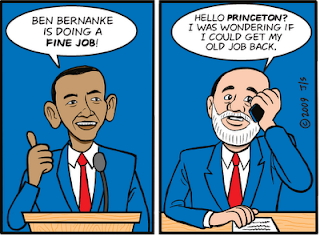

I used a "wait and see", according to the game, tactic. I thought reacting to public speculation would in turn cause what I was trying to prevent. Even though inflation went up 1% I was still dismissed. Thanks Obama.

Seth Jokinen

4th

Well, I definitely followed a keynesian point of view when I played. I was doing okay, I think as my people suffered from some small deflation and soaring unemployment rate, but these things happen. Overall, I did not completely destroy the economy and I lived long enough to be dismissed, so all went well and no one important died.

Saimol Edaparampil

4th Period

In my experience, the inflation rate keeps on going up no matter how much higher the federal funds rate is above the inflation rate. Also, the unemployment rate shifts depending on the inflation and federal funds rate.

Period 4

For my term as Fed Chairman, it seemed like dramatic changes constantly happened while I changed the Fed fund rate. Overall, it was hard to maintain the unemployment rate and inflation rate within the ideal target rate. It very much seems that this would be a stressful position to handle and have a lot upon your hands.

Gabriel Camera

4th Period

The first time I played it without reading anything and it was a total disaster. My inflation rate and unemployment rate lines were not even on the screen.

After I read the Learn more and the side instructions I learned how to control both lines with only changing the federal fund rate.

Prerna Kamnani

Period 1

I was a very poor Fed Chairman. My inflation rates would constantly be increasing as well as the unmeployment rates. However, I did manage to come with a strategy to decrease inflation. By increasing the federal funds constantly, I was able to decrease the inflation rates drastically to about .7% which made unemployment rates rise rapidly. The ideal federal fund rate is a delicate balance. It is definitely difficult, and I did not perform well with this at all. However, I did enjoy the game all together. I think it really did give insight on how trivial it is to maintain low unemployment rates and low inflation rates simultaneously.

Nicolas Alba

Period 3

The game can be a difficult because there are always things that make it unpredictable. Obviously the goal is to keep inflation and unemployment relatively low. But once you can somehow manage to get things stabilized, the game gets a little easier.

Period 4

I was not the best Fed chairman, but I probably could have done worse. I tried to remain fairly discretionary by trying not to fluctuate the federal funds rate too drastically and increasing or decreasing it according to how interest and unemployment rates responded. However, the rates did not respond as I anticipated they would so my strategy was not very effective.

Period 1

The strategies I used for this game included trial and error and trying to balance unemployment and inflation through making small changes rather than taking drastic measures. Because of the lags that the economy encounters when the Fed tries to "fix" the economy, it's hard to maintain balance by making huge changes that may seem appropriate at the time. It's important to foresee how the economy will behave in order to adjust properly, even though it's hard to expect or assume anything because the state of the economy is so fluid, but the idea is to carefully make adjustments that will not over or under-compensate for what's going on with the economy at the time. This game was pretty difficult. It's a tough job, being Fed Chairman. Props.

The game was a simple game, but alittle confusing at times. Sometimes I would increase the fed int rate, but that wouldn't lower inflation.

Tori Daniels

3rd Period

By playing this game, I realized that I am not fit to be the federal chairman. While I kept unemployment rates low, inflation remained high. I was terrible at that game. However, I now understand that it is hard to manage both the unemployment rate and inflation rate at the same time. I attempted to keep the unemployment rate low, but in turn inflation rose. I did not try to drastically change government spending at all. I tried to stay pretty much at the same rate. Turns out my plan was terrible.

Matt Louis

3rd

I enjoyed the game. I played twice. The first time I quickly increased the rate dramatically then kept it constant before quickly dropping it to 0, crashing the , market and deprecating the dollar. The second time I focused on keeping everything constant by adjusting to the little things that came up. I was successful and re-appointed but its amazing how changing one number can effect so much.

Matt Louis

3rd

I enjoyed the game. I played twice. The first time I quickly increased the rate dramatically then kept it constant before quickly dropping it to 0, crashing the , market and deprecating the dollar. The second time I focused on keeping everything constant by adjusting to the little things that came up. I was successful and re-appointed but its amazing how changing one number can effect so much.

My strategy was to match the inflation rate for the terms that it was going. A lot of the time, there was a rise in oil prices and that sufficiently hiked up inflation rate. That was a huge challenge because it caused the inflation rate to move in opposite directions with the unemployment rate. And that caused for me to take drastic measures to stabilize the economy. There were times where the green line would just move like a rocket and fall like a rock. And the red and blue line would twist and turn with each other like a sinusoidal graph.

Akshay Thakor 4th

the game was fairly simple.my main strategy was to correct the inflation rate mainly. that will effect the unemployment rate. so paying attention to the inflation rate is crucial. i played it several more times and the games was fairly consistent (probably because i learned the trick right away)

Allen Jose

1st period

The game was very simple and easy to manage. My strategy was just to find an interest rate that balanced both Unemployment and Inflation to an acceptable rate. By following this i was able to end the game at a decent unemployment and inflation rate.

Brookley Torres

4th Period

The game was pretty easy for me, I can see how it is hard to adjust for the different issues occurring and to keep a steady unemployment rate as well as a steady interest rate. Constant adjustment and compensation is required to keep a steady rate for both but it is not impossible.

So in essence, I am a failure. I took the approach that I should have as little unemployment as possible, so my inflation ended up at a peak of 10%. I then just drove interest rates so high that the economy settled in a matter of one period of time. I like to keep things interesting.

I played the game twice the first time I tried to not mess with the system too much and that led to the economy being ok for a while but then the oil crisis happened and everything was a disaster i tried to push the fed rate up in increments to decrease inflation but the inflation rose faster then i expected and i was fired due to high inflation rates.

The second time i was prepared or so i thought i knew that not reacting fast enough due to inflation could lead to the inflation getting out of hand so i hiked the fed rates up at the first time of inflation. Unfortunately i made them too high and i was fired this time due to deflation

It seemed as though no matter what i did i would be fired and the game gave me perspective how hard it must be to keep the economy in line.

My main strategy in the game was to not mess around with the federal funds rate too much unless the inflation rate or the unemployment rate changed a lot. It took me a few times to get the hang of the game, most likely from my skimming over the instructions. The unexpected events were the hardest for me to control, which I have to admit that I did very poorly on. However, all in all, I think I did an okay job on the game.

Caleb Bledsoe- 3rd Period

At first I didn't understand how to work the game but the second time I played it I noticed that if I kept the rates fluctuating between 3 - 4.5 the economy would keep expanding but in the end the employment rate was super high so that was no good :/

Overall, I thought I was a pretty decent Federal chairmain as my strategy of keeping the federal funds rate close to the inflation rate was keeping the unemployment rate close to 4.10% and the inflation rate near 2%. All was well until an oil crisis hit and I lost control of the economy since changes I made didn't have immediate effect. Raising the federal funds rate at that point did not lower the inflation level at all. Such unexpected events need to be taken care of immediately instead of gradually adjusting to them as I did.

Overall it was a well laid out game that went rather smoothly. Possibly because the amount of unexpected occurrences seemed to have stayed to a minimum for me. Either way, I mainly just followed the game's advice and adjusted the federal funds accordingly and only touched the interest rates if I knew how long to account for possible lag (which was really just a guessing game).

My strategy was just to mess with the numbers to get sort of the feel of the economy but it clearly was not a good idea because my inflation rate eventually went all the way into the negatives. Negative 3.00% to be exact. I just kept raising the federal spending and as I did so unemployment would raise so that was clearly a bad idea too. I started to decrease the amount of funds and unemployment still kept on rising although the number for the government was not that high ($8). Afterwards I just decreased it to about 4 and that was when I started to notice a decrease in the amount of unemployment, but inflation was still unfortunately -3. Although I managed to sort of fix the problem, inflation was not fixed.

Mohammad Abdel-Aziz

Period 3

Overall, I messed around as much as possible playing with both extremes as much as possible to see how unemployment and inflation were affected by the extremes. It was rather fun seeing how easily I could manipulate the economy within one quarter. I, without a doubt, would be terrible as the Fed Chairman, although the game did say I was reappointed. So, you never know, maybe I'll be the Chairman one day!

John Moore

3rd Period

This game was fairly easy, my strategy was to keep as close to the quotas as possible through fighting either inflation or unemployment with either strict or open monetary policy.

My strategy in this game was to first focus on the inflation rate then when I realized unemployment was being raised to high I started to focus on unemployment. I usually set the federal fund rates either to the very high end of 19 percent or the very low end with 0 percent. In the end my inflation rate was 1 percent and my unemployment was about 4.5 percent.

I had a excellent time as chairman. I ended up with a unemployment rate of 5.62% and inflation was slightly over four. I struggled for a while after the sharp changes in the market but was able to balance the economy just enough to keep my job at the end.

Harrison You

4th Per

The primary principle in this interesting game is that changes in the federal fund rate will take two to three quarters before it has a substantial effect unemployment and inflation rates. In order to obtain the levels we want, we have to pay close attention to how much the rates drop or rise. In the case of unexpected events, we have to be ready to make huge changes in the federal fund rates to prevent ridiculous drops or rises.

Alvin Mei

4th Period

The game was pretty easy overall. I tried to keep inflation and unemployment low so that I would be prepared for unexpected events such as drastic changes in either unemployment of inflation. Paying attention to the headlines and graphs are important too because it gave me useful information that I can use to change rates and such.

My strategy was based on a trial and error. If I saw that inflation was rising, I'd make sure to increase federal funds rate thus discouraging investment spending (through the increase in interest rates). However, once I saw that unemployment was rising to high, I'd switch and decrease the federal funds rate until the desired numbers were established. Instead of changing the federal fund rate every quarter, I'd leave the federal fund rate the same to determine how the economy goes in order to account for the time lag between federal fund rate and influence on inflation and unemployment.

saira sultan pd. 3

my main strategy was to keep the unemployment rate stable as well as the inflation rate. the game in my opinion was easy.

It's important to foresee how the economy will behave in order to adjust properly, even though it's hard to expect or assume anything because the state of the economy is so fluid, but the idea is to carefully make adjustments that will not over or under-compensate for what's going on with the economy at the time.

One has to pay attention to the pattern of the rates as they drop and rise in all honesty.By paying attention to the news headlines i was able to manipulate the inflation rate closely to my desired point.

Mansi Inamdar

1st period

This game wasn't so bad once i started to play. Overall what I tried doing is made sure that inflation rates and unemployment dont get too high and if they do then I had to maintain it back down

Anthony Chenevert

3rd Period

The game was fairly simple. My main strategy was to correct the inflation rate mainly. that will effect the unemployment rate. so paying attention to the inflation rate is crucial. i played it several more times and the games was fairly consistent.

Post a Comment